Social Security Deduction Cap 2024. One cannot access pension funds before the retirement age in the uk. In 2024, you can earn up to $22,320 without having your social security benefits withheld.

Inflation cooled considerably in 2023, but consumer prices still went up,. How we deduct earnings from benefits.

Inflation Cooled Considerably In 2023, But Consumer Prices Still Went Up,.

One cannot access pension funds before the retirement age in the uk.

In 2024, Only The First $168,600 Of Your Earnings Are Subject To The Social Security Tax.

For 2024, the social security wage cap will be $168,600, and social security and supplemental security income (ssi) benefits will increase by 3.2 percent.

You File A Federal Tax Return As An Individual And Your Combined Income Is Between $25,000 And $34,000.

Images References :

Source: elissaqnatasha.pages.dev

Source: elissaqnatasha.pages.dev

How Much Is Social Security Tax In 2024 Wynny Dominica, The social security taxable maximum is adjusted each year to keep up with changes in average wages. The 2024 tax limit is $8,400 more than the 2023 taxable.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, In 2024, the social security wage base limit rises to $168,600. If your retirement plan involves falling back on social security alone, here's some important information.

Source: kaleenawjuana.pages.dev

Source: kaleenawjuana.pages.dev

Sss Contribution Bracket 2024 Eddi Nellie, The social security taxable maximum is adjusted each year to keep up with changes in average wages. As a result, in 2024 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security.

Source: www.slideteam.net

Source: www.slideteam.net

Social Security Deductions Paycheck Ppt Powerpoint Presentation, For 2023, the wage base was $160,200. For earnings in 2024, this base is $168,600.

Source: retiregenz.com

Source: retiregenz.com

What Is Social Security Deduction? Retire Gen Z, The social security limit is $168,600 for 2024, meaning any income you make over $168,600 will not be subject to social security tax. In the us, it has to be withdrawn or held until the retirement age.

Source: diy.rootsaction.org

Source: diy.rootsaction.org

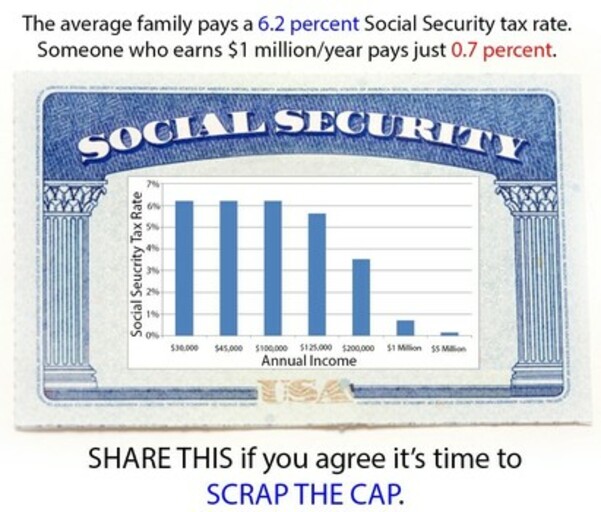

Eliminate Social Security Deduction CAP RootsAction, For 2024, the social security wage cap will be $168,600, and social security and supplemental security income (ssi) benefits will increase by 3.2 percent. How we deduct earnings from benefits.

Source: retiregenz.com

Source: retiregenz.com

What Is Social Security Deduction? Retire Gen Z, The difference between that and the earnings limit is $7,680, so $3,840 — half that amount — would be. If your retirement plan involves falling back on social security alone, here's some important information.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

What Is Medicare Deduction From Social Security Check, As a result, in 2024 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security. For 2024, the supplemental security income (ssi) fbr is $943 per month for an eligible individual and $1,415 per month for an eligible couple.

Source: retiregenz.com

Source: retiregenz.com

What Is Social Security Deduction? Retire Gen Z, In 2024, this limit rises to $168,600, up from the 2023 limit of $160,200. The federal government sets a limit on how much of your income is subject to the social security tax.

Source: sommerfotodesign.blogspot.com

Source: sommerfotodesign.blogspot.com

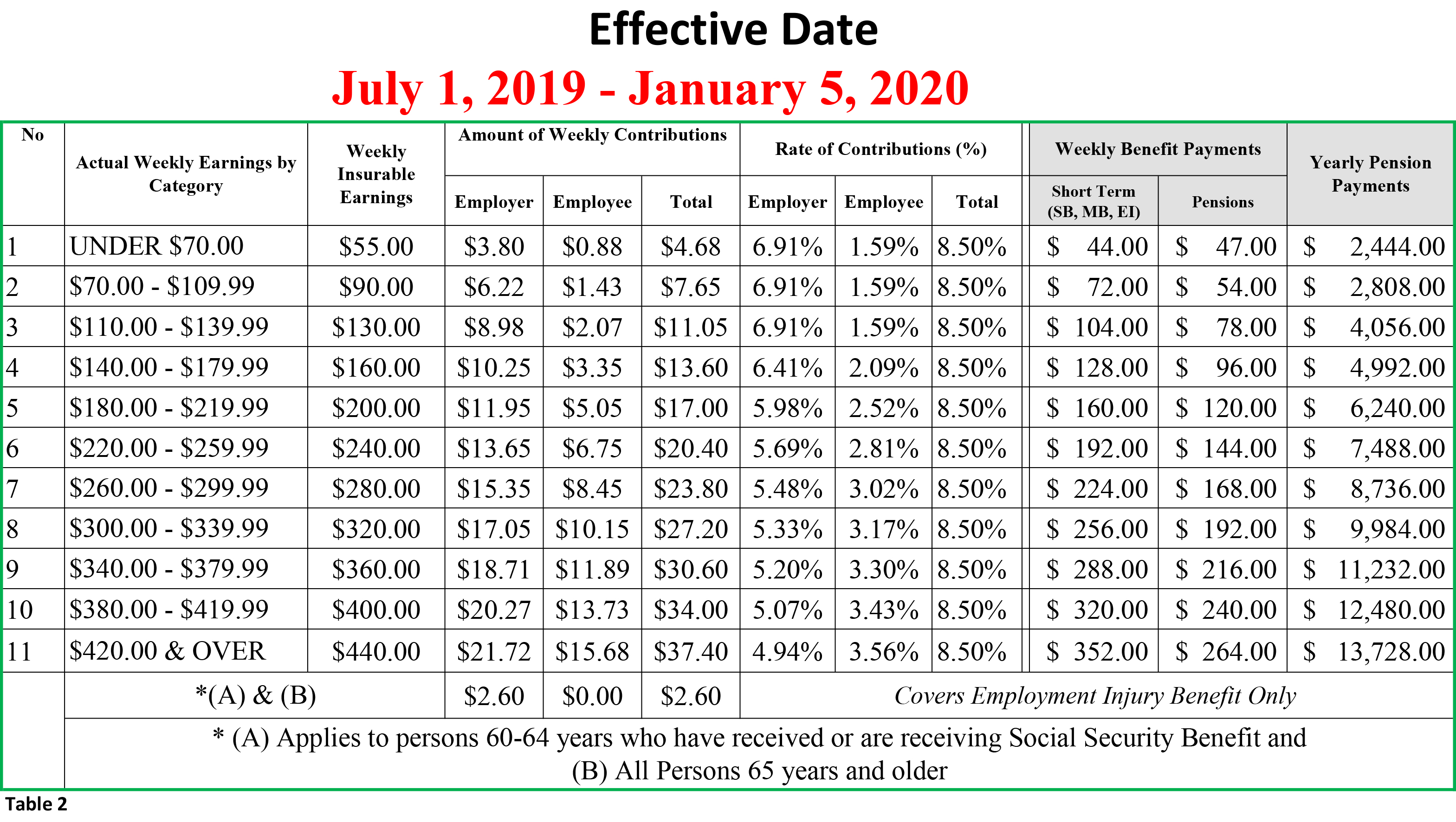

Sss New Contribution Table 2021 The sss basically derives its funds, For 2024 that limit is $22,320. The federal government sets a limit on how much of your income is subject to the social security tax.

For 2024, The Social Security Wage Cap Will Be $168,600, And Social Security And Supplemental Security Income (Ssi) Benefits Will Increase By 3.2 Percent.

This amount is known as the maximum taxable.

In 2024, This Limit Rises To $168,600, Up From The 2023 Limit Of $160,200.

The social security cap increase for 2024.